#Noi calculation how to#

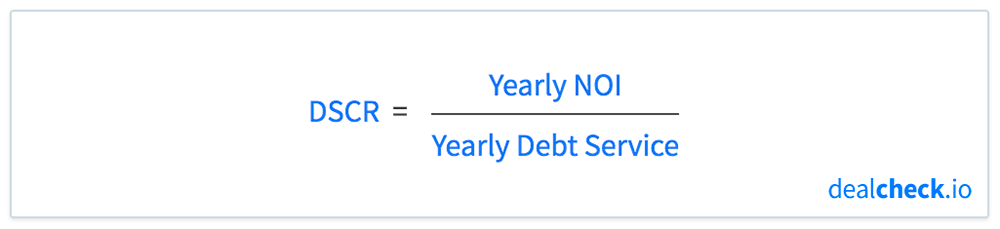

In addition, while it may seem that the net operating income formula is similar to the cash flow formula, you’ll realize that they’re actually different metrics once you learn the components of the NOI formula and how to calculate net operating income. While the NOI can change over time, as the investment property’s revenue and expenses fluctuate, real estate investors still believe that it provides valuable information about whether a given property will make enough rental income to support payments on its debt. In other words, the NOI formula enables real estate investors to get a better look at the potential profitability and financial health of an investment property in relation to how much it costs to operate it.

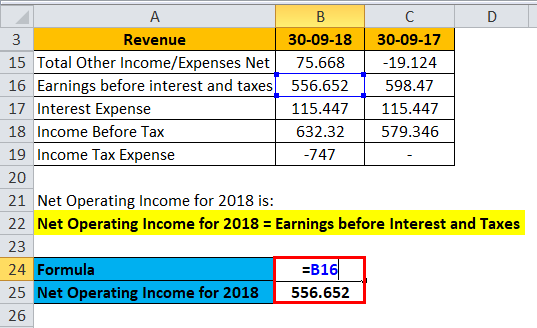

In real estate investing, the net operating income is a formula to measure the amount of annual profit a rental property brings in after taking into account all income collected (or revenue) and subtracting its expenses. To get a firm grasp of the NOI, its components, and how to use it to evaluate investment properties, keep listening.

Therefore, understanding the NOI formula is vital to make smart decisions in real estate investing. This makes the NOI a valuable standard for analyzing any real estate investment and even for comparing potential deals. And the net operating income or NOI formula is one of the most important metrics real estate investors can use to calculate expected profits and a property’s value.īy simply measuring the ongoing costs of owning a rental property, an investor can analyze how much money he/she can potentially earn.

Naturally, the profit from a given rental property is an important factor for determining whether or not it’ll make a good investment. In today’s podcast episode, Bill explains why NOI is so important, how to calculate NOI and how you can use NOI to estimate and leverage value. And the net operating income or NOI formula is one of the most important metrics real estate investors can use to calculate expected profits and a property’s value. No matter where you are in your career as a real estate investor, you’ll benefit from understanding how to evaluate investment opportunities. SHOW NOTES FOR EPISODE 326: UNDERSTANDING NOI AND HOW IT IMPACTS A PROPERTY’S VALUE

0 kommentar(er)

0 kommentar(er)